Account Details

Get started by filling in some basic information —date-of-birth, gender, marital status, preferred and alternate means of contact— to store in your personal details. Once complete, we recommend adding your Primary Residence as the first item in your Important Locations.

Important Locations

Desk drawer? Filing cabinet? Safety deposit box? Storage facility? While you may populate your vault in any order you choose —on your own terms and at your own pace!— we do encourage you to round up important locations, first; so they are readily available to you when you’re identifying the whereabouts of vital records and assets.

Arrangements + Wishes

Interment Preferences? Donations in lieu of Flowers? Religious Affiliations? Funerals can be surprisingly expensive. Detail personal wishes for services, along with your desired OR prearranged method of funding. Choose a trusted family member, friend or advisor to be primarily responsible for carrying out your wishes. Keep them updated as you add details over time.

Devices + Logins

Gadgets? Apps? Subscriptions? Social Media Accounts? Help trusted survivors navigate your digital world. Simply choose the type of device or account, include associated login information, and provide safeguarded hints for stress-free access and timely deactivation.

Beneficiaries

Friends? Family Members? Financial Dependents? Add your intended Beneficiaries, so you can document your wishes for each of them —individually and securely— in your personalized vault. Don't forget to let them know that you’re using the XV app for your own peace of mind, as well as for theirs. Invite them to join FREE.

Charitible Organizations

Charity? Church? Research Foundation? Help sustain a cause that is meaningful to you. Simply provide the nonprofit organization's legal name and charitable registration (Tax ID) number for legacy gifts. Depending on the type of bequest, either you —or your heirs— can enjoy certain tax advantages.

Advisors + Lawyers

Estate Lawyer? Financial Planner? Insurance Broker? Tax Attorney? Your trusted advisors can help you, today —and your loved ones, tomorrow— by identifying potential gaps in your overall plans and by alerting you to potential tax implications for your heirs. We encourage you to involve them. Remember, they can only see what you grant them access to see.

Additional Contacts

Tenants? Care Personnel? Trusted Service Providers? Your loved ones should know who to contact, for what reason, and how best to reach them. Make things easier for your heirs by storing this information all in one safe place. There's no need to store your entire address book. We recommend only including additional contacts your heirs will need to reach out to —and interact with— in relation to your end-of-life plans and bequeathed assets.

Accounts + Investments

Checking? Savings? IRAs? 401Ks? Your heirs may get tied up in probate dealing with specific financial accounts unless you designate Beneficiaries. They will require account statements —copies or originals, depending on the investment type and the individual institution— so be thorough, consult your bank, and try to keep your records up to date.

Insurance Policies

Annuities? Life Insurance Policies? Final Expence Coverage? Over $6billion in life insurance policy payouts go unclaimed, each year, solely because survivors don’t know that a policy exists OR where to find it. Protect your loved ones by documenting your policies.

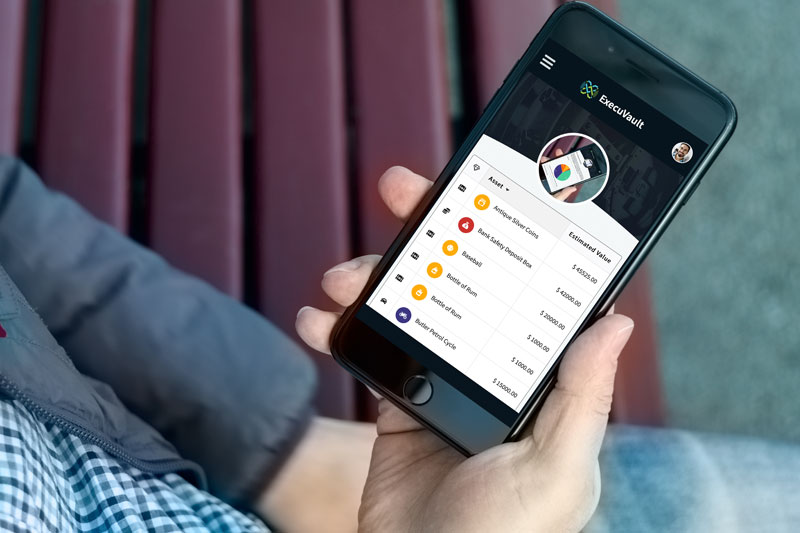

Collectibles

Family Heirlooms? Antiques? Valuables? Whether they are of significant monetary —or strictly sentimental— value, bequeathing family heirlooms can be a stressful undertaking. Have an open discussion. Express your wishes, but also listen to your loved ones: a specific item may hold much more meaning for one individual than for another.

Planned Allocation

Review the contents of your personalized vault at a glance. Visualization charts and graphs will help you identify gaps and unintentional allocation imbalances in your planned legacy transfer. Get the most out of XV by sharing reports with your trusted estate planning advisors or legal professionals.

Prospective Inheritance

Provided you have been granted visibility of planned bequests —by any one or more of your connected Benefactors— those individual Assets will appear in your Prospective Inheritance. Remember, you can only see what they have permitted you to view, so you may notice 'hidden' (undisclosed) Assets as well.

Privacy Settings

Your privacy is of the utmost importance to us. Visibility of everything you have documented, catalogued, and assigned —in your vault— is turned OFF by default. You may choose to enable "view-only" access for specific family members, friends, or trusted advisors. Each will require their own XV account in order to view any information you have granted them access to.